ESG data fact-oriented.

Blockchain - powered.

Sustainability driven.

HERMESNET streamlines ESG and sustainability data collection, calculation and reporting through an intelligent SaaS platform

ESG data fact-oriented.

Blockchain - powered.

Sustainability driven.

HERMESNET streamlines ESG and sustainability data collection, calculation and reporting through an intelligent SaaS platform

ESG data fact-oriented.

Blockchain - powered.

Sustainability driven.

HERMESNET streamlines ESG and sustainability data collection, calculation and reporting through an intelligent SaaS platform

Our products — for all sizes and types of organisations

With the help of cutting-edge technologies (AI, cloud collaboration and blockchain), our products help to identify ESG starting point, engage stakeholders, build a reporting template utilising leading frameworks (TCFD, GHG and SDG), collect & validate ESG data, generate ESG report and automate the process

GTR

Green trusted reporting

GTR is an ESG reporting and sustainability management solution for businesses on blockchain:

- Leading frameworks (TCFD, SDG, and GHG protocol)

- Streamlined ESG data collection, validation & consolidation

- AI-powered materiality assessment

- Trusted blockchain databases

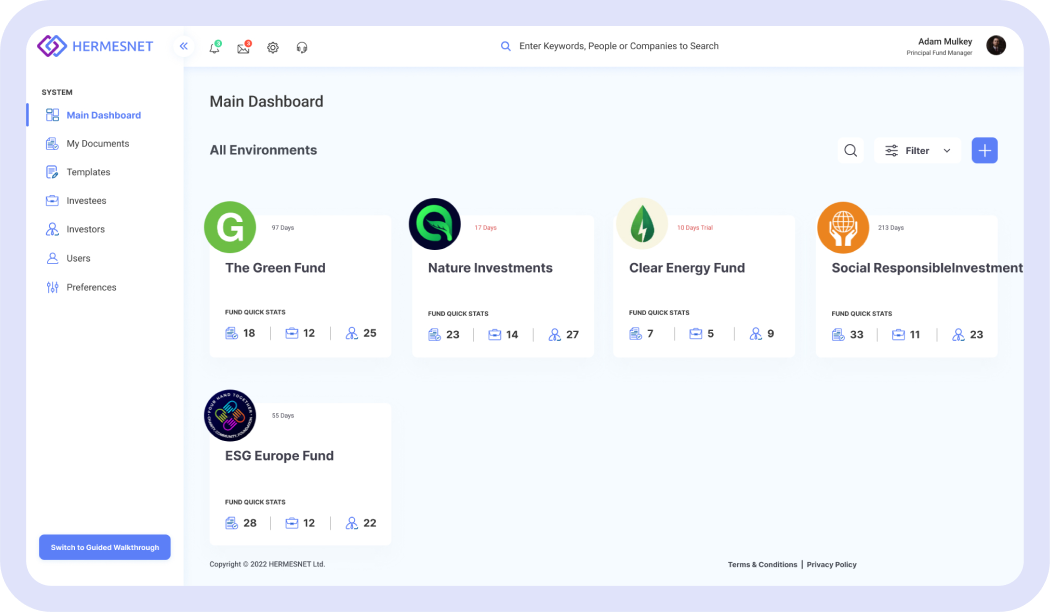

PE Reporting

An ESG SaaS reporting and sustainability management software for the Private Equity and Venture Capital industry:

- ESG and financial data and consolidation collection

- ESG data audit

- Portfolio monitoring

- ESG and financial investors reporting

GTR is an ESG reporting and sustainability management solution for businesses on blockchain:

- Leading frameworks (TCFD, SDG, and GHG protocol)

- Streamlined ESG data collection, validation & consolidation

- AI-powered materiality assessment

- Trusted blockchain databases

An ESG SaaS reporting and sustainability management software for the Private Equity and Venture Capital industry:

- ESG and financial data and consolidation collection

- ESG data audit

- Portfolio monitoring

- ESG and financial investors reporting

Key features

Collaboration and stakeholders engagement

HERMESNET brings together everything and everyone you need to tell your ESG story. Invite your stakeholders, tag teammates, divide tasks, communicate straight on the platform, plug & play with external data sources and share ESG reports on the platform.

Leading ESG frameworks

HERMESNET automates ESG processes and makes them compliant with leading ESG frameworks such as TCFD, GHG, or SDG.

Supply chain management

Hermesnet’s straightforward plug & play approach enables to engage supply chain participants, build dedicated sustainability data collection environments, connect the suppliers’ systems, and automatically populate their data into your templates.

Streamlined data collection

No Greenwashing with blockchain trusted database

Ensure the accuracy of your ESG data and get your ESG report signed utilising the auditing tools. When your report is audited, the system automatically writes it down on the blockchain creating a single immutable source of your ESG trusted data.

Easy to get started

Hermesnet enables an effortless start of your ESG journey with an automatic materiality assessment and a list of recommended material topics to report on, tools to select the required functionality, match and mix, align with existing processes, and archive needed efficiency.

Cutting-edge technologies

AI and machine learning

Hermesnet employs AI and machine learning to onboard, profile, and identify a business's material items and generate an ESG reporting template.

Cloud collaboration technology

Enterprise-level cloud collaboration technology allows engaging stakeholders to work together on documents and other data types on one end-to-end encrypted platform.

Blockchain

The blockchain element creates accountability, making exchanged data trustable and building immutable history of the data exchanged between participants.

For large, medium and small businesses

GTR enables corporates, despite their ESG expertise, automatically perform materiality assessment, build ESG reporting templates (compliant with leading frameworks TCFD, GHG, and SDG), engage stakeholders, collect ESG data (including supply chain data), audit collected data, generate an ESG report and share the report with interested stakeholders.

For private equity investors & managers

An ESG SaaS reporting and sustainability management software for the Private Equity and Venture Capital industry. PE Reporting streamlines ESG and financial data collection, portfolio monitoring and investor reporting using Blockchain technology.

GTR enables corporates, despite their ESG expertise, automatically perform materiality assessment, build ESG reporting templates (compliant with leading frameworks TCFD, GHG, and SDG), engage stakeholders, collect ESG data (including supply chain data), audit collected data, generate an ESG report and share the report with interested stakeholders.

An ESG SaaS reporting and sustainability management software for the Private Equity and Venture Capital industry. PE Reporting streamlines ESG and financial data collection, portfolio monitoring and investor reporting using Blockchain technology.

Newsroom

Looking Back on 2023: A Year of Progress

Dear Partners, Shareholders, and Followers, We are presenting to you the review of our business for 2023. HERMESNET kicked off the year of 2023 with a unique set of...

Merry Christmas and a Prosperous 2024 New Year!

As the merriment of Christmas fills the air, HERMESNET Ltd. takes a moment to express our heartfelt gratitude to our valued customers, partners, and friends around the world. This...

HERMESNET November 2023 Update

As the Festive season is just around the corner, we in HERMESNET have been working hard to ensure that the needs of our customers are being served and the...

What challenges do businesses face with their sust...

Recently, we asked our customers about their ESG & Sustainability reporting challenges. They told us that it has become increasingly important to tell their ESG story using not only...

Clients and partners

Ready to get started?

Request a demo and we’ll send you more information and set up a call to demonstrate our solutions.